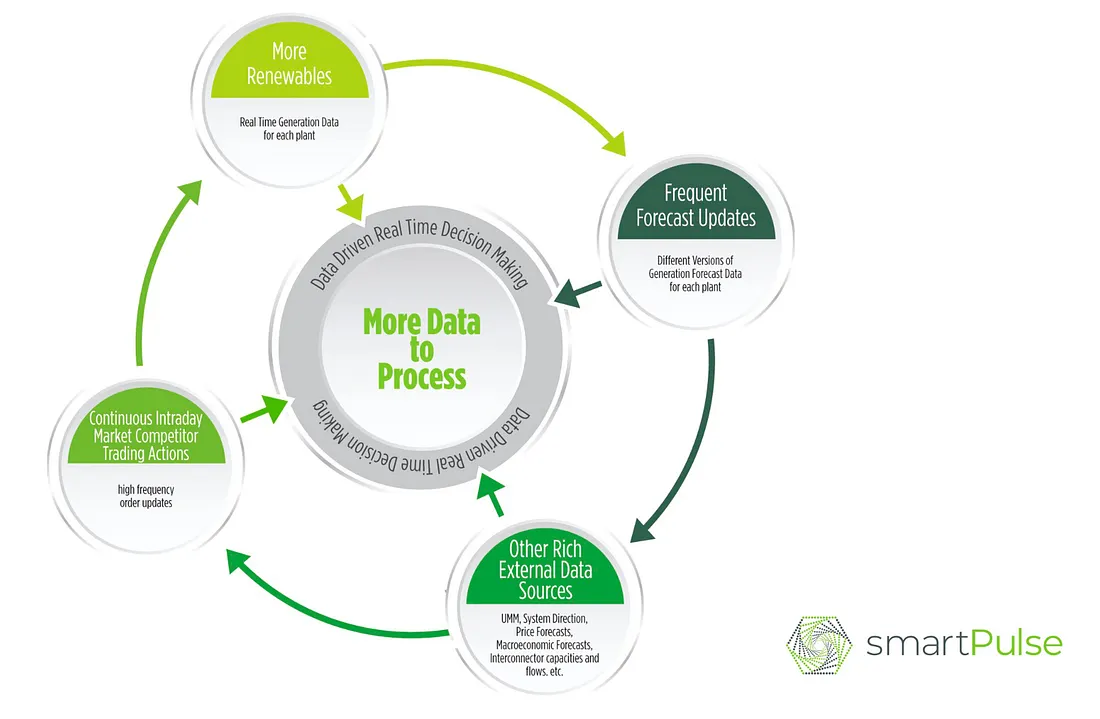

As we have covered in our previous posts, the renewables provide intermittent generation, which is dependent on weather forecast. The increase in the number of renewables connected to the grid results in the need for managing more data, operating closer to real time, underlining the need to tap into high volume of streaming data from OT (Operational Technologies: e.g. SCADA, EMS, DMS) and trading IT and rich external data sources to support in near real time decision making. Bridging the gap between traditional data siloes is vital to exist in the new normal.

To add to the sophistication of the electricity trading environment, new marketplaces are being introduced by system operators and market operators at every level to enable more efficient management of ever-increasing volume of distributed energy resources, in line with the efforts to support net zero targets.

As an example, let’s have a look at a few of the the real time decision making use cases for continous intraday market, which exists in most of the European style energy markets:

- Frequently updated weather and energy generation forecasts for renewables during the intraday provide opportunities to reduce imbalance costs through efficient trading in intraday continuous markets.

- Near-real time optimisation of the generation plans of controllable generation units.

- Leveraging arbitrage opportunities in the continuous intraday market, made possible by fluctuation of the price for the same contract.

- The charge/discharge of new energy storage technologies and activation of demand side flexibility.

Ultimately the decision is to bid or ask: when, how much and at which price.

The need to process large volumes of data in a very short amount of time is changing the short-term trading business for good, rendering it impossible to manage manually. Robots are able to trade in continuous market, reacting to changes in milliseconds, opening an opportunity for high frequency trading at continuous electricity markets.

What about the amount of trading activity that is increasing by the help of robots? Real time and historic order book data adds up to the geometrically growing pile of data to process…

Across the European continuous intraday markets, the number of executed trades increased 3x from 2019 to end of 2021 and the total volume of trades (in MWh) more than doubled in that period.

Robotic trading and SIDC (Single Intraday Coupling) project are the main drivers behind this significant increase in volume.

We believe in building an interoperable ecosystem

Technology is the enabler of this transformation and business will need to transform, new roles emerge: e.g. Data Engineering, ML Ops, etc. old roles will need to change: e.g. future traders need to be apt in conceptualisation of trading strategies and be proficient in methodologies like extreme programming and agile development. (Please see this post for a discussion of the future trader role)

At smartPulse we believe the ultimate solution fit for the future of energy trading landscape is an interoperable “ecosystem of platforms and models” which also provides a seamless experience for the users. For this reason, we pursue open architecture, provide state of the art data sharing mechanisms utilising graphQL and APIs. We also want to grow with partnerships, giving our partners the ability to develop their own business. For instance, our platform is already connected to many commercial forecast providers. We envision a future where our partners can develop and provide specific AI powered services leveraging smartPulse platform, addressing different problems and needs.

Uygar Yörük